There is an abundance of career advice that talks about how taking career risks pay big, and how playing it safe can hurt your long-term career growth. However, how do we know when and what career risks to take? How do we recover if the risk doesn’t turn out as we had hoped? How do we take a career risk without risking financial responsibility to pay our basic necessities like rent or mortgage? Or jeopardize our reputation?

Well, let’s talk about all of those questions, let’s review career advice on how and when career risks pay big. Let’s discuss when to take career risks and how to not lose our basic needs in the process or our reputation. Let’s weigh in here on what career risks pay big and which career risks will pay the fastest. To be clear, here we are discussing career advice on taking ownership of your career finances through career risk management.

Career risk management is an important part of your career. Without owning your career risk management the career industry you are part of will decide which career risks you take when. When others decide career risks for you, it can sometimes work out in your best interest, and other times derail or hurt your career.

It is important in career risk management to understand the different career risks you can take and the pros and cons to each risk. After listing out and understanding each career risk it is up to you to decide when is best for you to take one if any of the career risks. Once you complete your career risk analysis it is important to share with your management what career risks you are interested in and which you are uncomfortable taking.

Career risks are a calculation that when managed and well thought out pay big. So, start today to own your career finances, your career future, and lead your own career risk management.

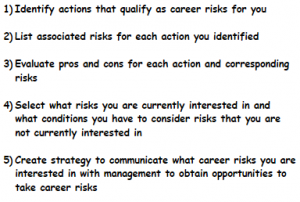

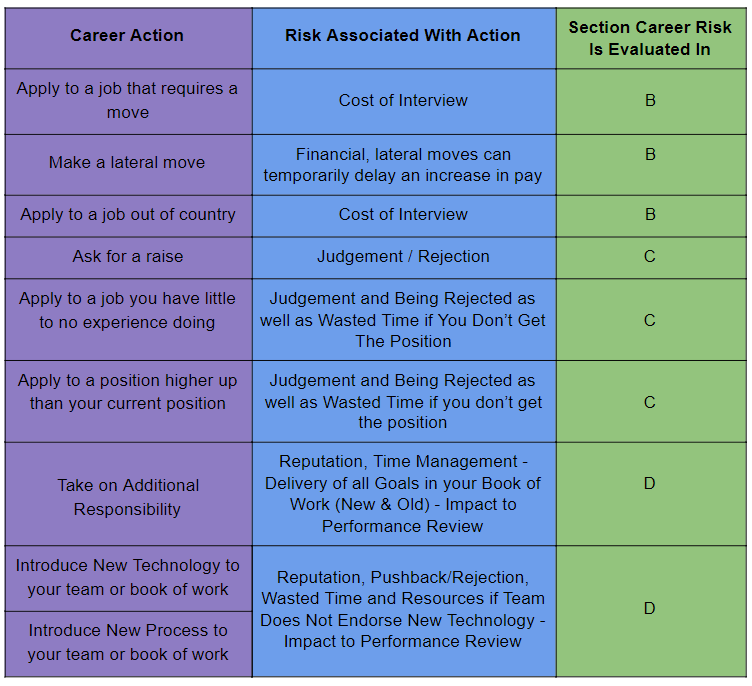

To own your career risk management you will want to take the following steps to analyze your career risks.

How To Own Your Career Risk Management

Steps 1 & 2

First, let’s begin with what qualifies as a career risk. A career risk is taking a career based action that has uncertainty around it. This can include everything from having a difficult conversation with your manager or manager’s boss to applying to a job you have little to no experience doing. Career risks can be focused around your skills or around location or around finances.

9 Examples of popular career actions that can pay big, and their associated career risks can be found in the table below.

Steps 3 & 4

The question when considering a risky career move, is whether or not you should take the risk. Only you know the answer to the question of whether or not it’s the right time for you to take a career risk. What I can share are questions or thoughts to help you evaluate the pros and cons of whether or not you should take a career risk.

Questions and thoughts to consider when evaluating whether or not to take a career risk can be found below.

To Consider

A) The first question you can always ask yourself if you are anxious about a decision is “What is the worst thing that could happen?”

The answer to this question can vary from person to person. Below I share what my personal worst fear is when it comes to taking career risks. Mine is a little extreme, so think through your personal scenario to identify your own worst fear. If you aren’t sure where to start then please see my answer below.

Whenever I ask myself this question in regards to my career the answer is always that, I could lose my job. If everything goes terribly wrong with a career choice I end up losing my job. I came to terms with this scenario a very long time ago, and accepted that it was ok if I lost my job.

It’s not ideal if I lose my job, but I could quickly find a job to bring in enough money for the bare necessities because of my location. Also, now I have enough in savings to get through a month without a paycheck if needed. So, if you have a plan B or know how you would manage without your job for a little while, then know that even if the worst thing happens you will be fine. You can move on from your current role and company and on to greener pastures.

If you live somewhere very remote with limited to no career options outside your current company, and have no intention of moving or taking a long commute then you may want to play it safe. Lean on the side of caution if you think any decision might lead to your termination and you feel that you have no opportunities to pursue if you are terminated.

Now that we have the worst out of the way, let’s get to other questions that address the risks in our table. Let’s start with money risks.

B) Can I afford to take this career risk?

For most of us the income from our career is a necessity to live. So the thought of putting one of our needs at risk sounds crazy. Well, we are taking career risks and some pay big and others lose. Let’s take a closer look at the career risks associated with cost and pay, to assess which can pay big.

Cost, what if the career action I am interested in costs me money?

This can occur when applying to jobs that are a long distance from where you are currently located. Long distance interviews can cost money if you have to travel as well as cost you if you get the position and need to move.

The question is, can I afford the expense of travel and/or a move? Well, this is a personal question and will be dependent on your personal financial situation. If you do not know the answer to this question I recommend you take a look at The Girl Ninja’s introduction to budgeting. There you can take a look at your overall expenses and see how much money you have to spend on travel and moving.

When assessing your budget you will want to look at the expenses expected from interview travel and a move if required. One way to reduce the costs of long distance opportunities is to ask the employer what expenses they will cover. Many companies will cover the cost of travel and some expenses of moving. So be sure to take those savings into account when asking if you can afford to take this career risk.

Remember, it does not cost anything to ask questions.

Another financial career move when you might ask can I afford this, is when you choose to make a lateral move. A lateral move is when you change roles but the new career position does not increase your pay or position title. These moves are often taken to diversify an individual’s experience.

When you make a lateral career move you don’t accrue any expenses. The risk for lateral career moves are short term financial risks. Do you have financial goals for your salary that you expect to reach in the next 1-3 years? If you do, then a lateral career move may delay you reaching short term salary goals.

Lateral moves can sometimes prolong promotions or career advancement because you need to take the time to learn and showcase your expertise in a new area. The time to learn a new expertise ranges from each individual and topic being learned. It typically takes 2-4 years to learn the new expertise and showcase your expertise in the topic before you receive recognition in the form of an increase in pay.

So, if you feel that your budget allows you to stay at your current salary for another several years then the risk of a lateral career move is very little to none for you. If you cannot afford to prolong a salary increase, then you have to consider putting off diversifying your expertise.

On the other side of the risks for taking a long distance job or a lateral career move is often a LARGE PAY INCREASE. Both career moves (long distance and/or a lateral move) display that you have the ability to be flexible and adapt quickly while delivering quality results. Once you successfully showcase your deliverables after making a lateral or long distance career move, you will have strong evidence to advocate for yourself for an increase in pay.

So even though there are short term financial risks associated with long distance or lateral career moves they also have the potential to PAY BIG down the road.

Step 5

Next, let’s talk about career advice when career risks put your reputation at risk or you risk rejection. The important note here is to create a strategy around your career risks, specifically a communication strategy. The creation of a communication strategy around your career risks puts your reputation in a position to grow in a positive way even if your risk doesn’t financially pay big.

The most popular communication strategy that leaders across multiple industries look for employees to display is called, The Growth Mindset. Below you will find career advice around career risks and how to apply the growth mindset to your career risk strategy.

C) What if I’m rejected, will it hurt my reputation?

Many career risks are associated with the fear of rejection if the career action you take does not workout. In the table above examples correlated with rejection include everything from asking for a raise to introducing a new process/technology to applying to a stretch goal position. The concern of rejection is a very common concern and manifests differently in individuals.

The first step is to identify if you are stunting your career through a fear of rejection. If you are, know you are not alone. The first step of getting over this hurdle is understanding your fear and facing your fear. As mentioned above in section A, my worst fear is a form of rejection, getting fired. Once I came to terms with my fear I was able to take career risks that previously I was too scared to take.

Another way to think about rejection that puts you in a better mindset is viewing professional rejection through the lens of a growth mindset. If you haven’t heard of the growth mindset I encourage you to learn more about it, and use it to advance your career. Here I will briefly explain the growth mindset, but I also encourage you to get the book below to make the growth mindset part of your daily way of thinking.

Growth Mindset Applied When You Don’t Get A Role You Applied To

Growth mindset is a strategic way of thinking. The most important takeaway lesson from the growth mindset is that even when you don’t succeed, when you don’t achieve your goal you use the experience to grow. The growth mindset is important to apply in your career as you grow. For example, if you apply to a position and are not given the position you should use the interview and feedback from the interview panel to further develop yourself.

A great way to use an interview panel for a position you did not get is to reach out to an individual from the panel after you hear that you did not get the position. When you contact the individual express that you are still interested in pursuing that position in the future. Then request their feedback for specific actions you can take to strengthen yourself as a candidate in the future.

Your request for feedback to apply to your development plan is a great display of your growth mindset and professional maturity. So, no you don’t get the job you wanted right then and there. However, you do obtain valuable information that will help you get to your desired position in the future. In this scenario the sooner you apply to those stretch positions the sooner you can buff out your development plan to be better qualified for your next career move.

Growth Mindset Applied When You Ask For A Raise

Another risk associated with rejection is asking for a raise. Typically, by the time most ask for a raise we feel that we more than earned a raise. Let’s take a moment though, and think about salary raises from the view of the business. At the end of the day, raises cost a business money. If you haven’t said anything about expecting a raise then the business will probably prolong a raise until they feel you are interested in a salary raise.

The growth mindset is a great way to approach your request for a salary raise. In a salary raise scenario you will apply a growth mindset in a preventative approach. Specifically to prevent you from getting to a point where you feel underappreciated because you think you more than earned a raise, and did not get one. To apply the growth mindset to salary discussions, it should be at minimum a bi-annual or quarterly discussion with your manager.

To initiate a growth mindset discussion around salary you can tell your manager in a one on one that you are interested in advancing your responsibility and salary. Inquire what your manager’s expectations are of you to be given more responsibility and an increase in salary. Before you ask for your manager’s expectations, it’s always good to propose some ideas of what steps you think you need to take.

Then follow up your ideas with asking for your manager’s alignment, and other expectations your manager has. Once you understand your manager’s expectations you should align with your manager on what specific actions you will take to meet your manager’s expectations. Following this meeting you should check-in with your manager in future one on ones (minimally bi-annually or quarterly) on your progress to ensure you are both aligned throughout the year.

Opening up a line of communication around yours and your manager’s expectations is important for your career growth. Making certain that both you and your manager are clearly communicating, and therefore aligned, is not always easy. It’s important to understand that business priorities change, and therefore your strategy to get a raise should be flexible or reflect the fluidity of business priorities. The changing needs of a business is why it’s important for you to have regular on-going discussions with your manager around expectations.

Know that getting a raise can be a process. If you truly feel that you have done everything outlined here, and your company is just making you jump through hoops with no recognition then it’s time you consider if that’s the kind of company you want to work for. If it’s not the kind of company you want to work for then flex your network, and start applying for positions that will give you a raise at a new company.

Bottom line is career actions in section C like asking for a raise or applying to stretch positions PAY BIG either in the form of money or in self growth and development, but can be a process.

D) Taking On More Responsibility or Introducing Something New To Your Team

Section D career actions are long-term investments that you take on for months or even a year or two at a time. All the scenarios in section D including taking on more responsibility or introducing something new to your team can PAY BIG if it is a success. The pay off for these options can lead to promotions, raises, job offers, or expanding your skills and experience to make you a more desirable candidate.

The risk of career actions in section D include failure in multiple forms. Some examples of failure from career actions in section D include not delivering on new responsibilities (not meeting goals and objectives) or not getting endorsement/alignment to implement the new thing that you brought in for the company. The con for any of the career risks in section D is a delay in getting rewarded.

To mitigate loss from taking on more responsibility or introducing something new to your team you will want to strategize your lessons learned. Obviously, this is only necessary if you take on more responsibility or introduce something new to your team and it does not workout. In this scenario you will strategize how to showcase what your company gained from your failure, and communicate it to get credit for your growth mindset.

If you sulk in your failure it is possible that the experience will cost you money through a poor performance review, that will decrease your bonus payout and/or delay a raise. If you are able to establish and implement lessons learned from your failure that will benefit the company, then you can expect a BIG PAY DAY. The big pay day from the lessons learned will take as long as it takes you to showcase your lessons learned, and successfully implement it as a department wide standard.

Through all of these scenarios you can see that all career risks can PAY BIG, if executed strategically. So if you want to take a calculated career risk that will PAY BIG professionally, consider creating your career roadmap with a growth mindset strategy to reach your end goal from the start of your career. The sooner you start to strategically plan the sooner you will see career risks PAY BIG at work.