Work is a love hate relationship for most. We need the financial payout from working, and we might even love the work we do. However, most crave the freedom of not having a daily 8 hour commitment. We long for the freedom to choose what and when we do everything. So, naturally the question we are all asking is when can I retire.

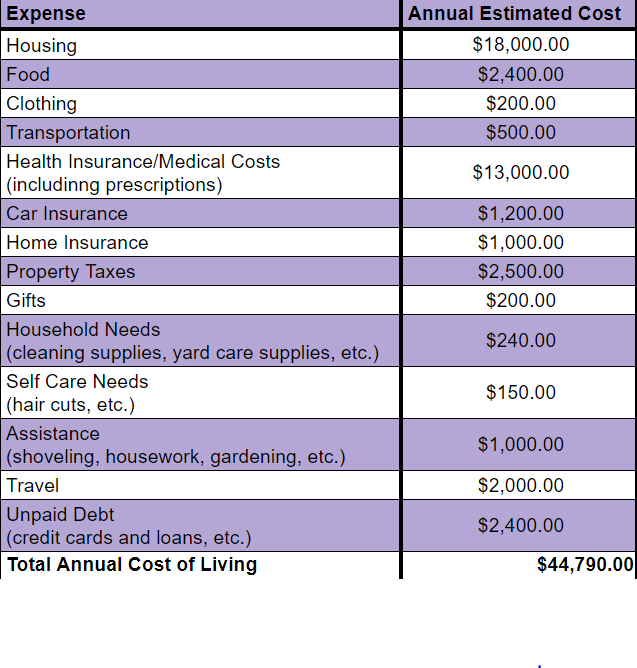

The answer to when you can retire is dependent on your needs and expectations. The best way to assess when you can retire is to begin by making a list of expected expenses you will have in retirement. This includes everything from purchasing gifts to paying for health insurance. Below, is a list of common expenses that most are responsible for paying in retirement.

Common Annual Retirement Expenses

Note: Listed expenses and associated costs are estimates of what to expect, not actual values, and will vary depending on your individual needs. You will need to add other expense not included in the table like income tax (even your retirement salary, including social security and 401k withdrawals are taxed in most states) and home and car repairs. It is recommended that you open google sheets or excel and make your own table of personalized retirement expenses, and use this table as a reference.

After you make a list of all your retirement expenses you will want to estimate an annual cost for each. As shown in the table above the total estimated annual cost of living (found from adding all the expenses together) is about $45,000. Once you have your annual expected cost of living in retirement you will want to figure out how much money you will get paid annually in retirement. Retirement salaries can come from governments, 401Ks, Pensions, IRAs, stocks, and other forms.

For those of us in the United States, we expect to receive social security. Money that our government collects from each of our paychecks and saves automatically for our retirement. Is the social security we will receive enough though?

If you do not know how much money you will receive from social security you can find an estimate on this social security website. When estimating how much income to expect from social security, be aware that the age when you start receiving social security income can affect your annual social security income. Age 62 is the earliest Americans can receive social security.

However, if you start to receive social security at age 62 it is about 30% less annual pay then if you wait till what is considered your full retirement age. Full retirement age according to social security is 66 years and 10 months. If you can wait until you are 66 years and 10 months to get social security, then you will receive the maximum social security payout.

Your social security income is determined by your average salary over 30 years, specifically your highest paid 30 years. So, let’s say your social security income results in monthly payments of $1,500, giving you an annual salary of $18,000. After all our hard work, $18,000 a year is not very much, and is not likely enough to cover all of your expenses in retirement.

One of the biggest expenses in retirement besides health care needs, is making payments for housing. Now if you own a home and it is completely paid off, you are in good shape. However, if your home is not paid off and you have to make monthly rent or mortgage payments your $18,000 may have to be completely dedicated to paying your monthly housing expense. This scenario leaves you with no money after monthly housing payments (assuming your monthly housing payment is $1,500) if you are solely dependent on social security.

As you can see, it is a good idea to plan on having more than social security as a means of income in retirement. 401ks and IRAs and other savings do not break it down for us annually though. So how do we know how much money we can take out from these accounts annually for our salary?

A general financial rule for long term saving accounts is the 4% rule. For 401ks and other accounts that receive profits from stock portfolios we assume that every year your money sits in these accounts, it will earn about 4%. This means that if you take 4% out of your 401k every year you will not run out of money, as long as the market is steady and makes you 4% every year.

Given the 4% expectation, if you choose to take 3.5% of your 401k for an annual salary it is considered conservative. If you choose to take 4.5% of your 401k for an annual salary it is considered risky, since you will be spending more money then you will make every year. This same percentage assumption can be made for any financial account that is earning profits from stocks.

Just like we apply the 4% assumption to stock market accounts, like 401ks, you can also apply percent earnings to accounts like high yield saving accounts and stocks and bonds. For those expected annual earnings you can check with your financial institution for what you can count on. For all your accounts, stock, savings, etc., you will need to decide for your situation what accounts you want to be conservative on, if any. You will also need to decide which accounts you want to remove money more aggressively from at a higher percentage, if any.

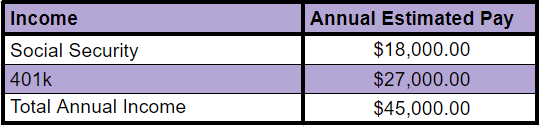

Once you decide what percentage you will take from each account every year, you can add those values up for your total annual salary in retirement. Below is an example, you can use the table below to fill out your own expected total annual income, to know if you can afford to retire. If you go through your budget and find you cannot afford to retire yet, you can go below the table to calculate when you can afford to retire.

Expected Annual Income in Retirement

Let’s walk through an example where an individual is 45 years old and has $500,000 in a 401K. They expect to need $45,000 a year in retirements and expect to get $18,000 a year from social security. With $500,000 in a 401k they can withdraw 4% annually for an annual salary of $20,000 from their 401k. In this example, a total annual income of $38,000 cannot cover your expected $45,000 expenses. Below we will walk through an example of how long it will take an individual to get from $38,000 a year to $45,000 a year.

If you do not have enough to retire yet, let’s figure out when you can retire. You can increase your retirement income through multiple methods. Here I list 3 ways to increase your retirement income.

A) You can increase your contributions to retirement funds like 401ks.

B) You can plan to take a part time job in retirement.

C) Then there is social security, the only two ways to increase your social security pay in retirement is to increase your annual salary prior to retirement or prolong your retirement.

– Increasing your annual salary will automatically increase your social security contributions, and as a result increase your social security payout.

– If you want to retire at 62, waiting to retire until 67 can increase your annual social security salary by about 30%. This increase can possibly take you from $1500 a month to $2000 a month or increase your annual salary from $18,000 to $24,000.

Besides increasing your social security income you can wait to save more money in your 401k, and calculate when you will have enough saved in your 401k to retire. These calculations also apply to other retirement funds like roth IRAs. Let’s say you are 45 years old, and you have $500,000 in a 401k, for a current annual retirement salary of $20,000 (assuming you plan to take 4% out every year).

After completing the budget above, you realize that you need $27,000 a year from your 401k to afford to retire. This will bring your total annual salary of social security and a 4% withdrawal from your 401k up to the $45,000 needed. You will want to put the below formula in cells in excel or google sheets.

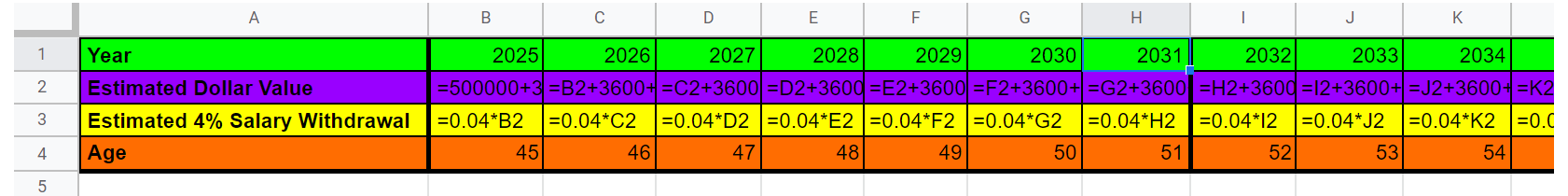

The below formulas calculate how much your 401k will be worth every year after it increases 4% and $300 is added to it monthly via paycheck deposits or $3600 a year. When entering the formulas you can edit the $3600 to your personal monthly contribution value for a realistic budget for yourself. You can also edit the starting 401k value, the years, and the age in the formulas.

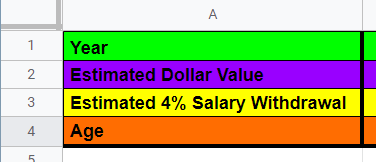

In cells A1 through A4 enter in the words shown below.

A1: Year

A2: Estimated Dollar Value

A3: Estimated 4% Salary Withdrawal

A4: Age

Once the information for cells A1-A4 are entered in, it will look something like the image to the right. I added color to my rows, it helps me visually track the row I am focused on, feel free to add colors to your cells to personalize your financial plan.

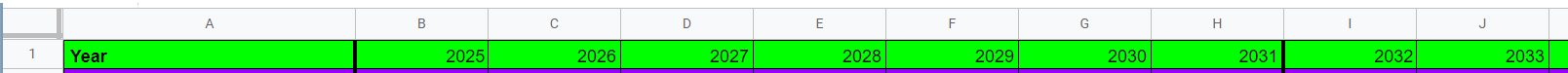

In Row 1, you will enter years in sequential order, for the years you are calculating the values for (the list below are example years). For the purpose of this example I only carried the formula out over 8 years, but you can extend this formula for as many years as you would like.

Cell B1= 2025 (next year)

Cell C1= 2026

Cell D1= 2027

Cell E1= 2028

Cell F1= 2029

Cell G1= 2030

Cell H1= 2031

Cell I1 = 2032

Once the information for row 1 are entered in, it will look something like the image below.

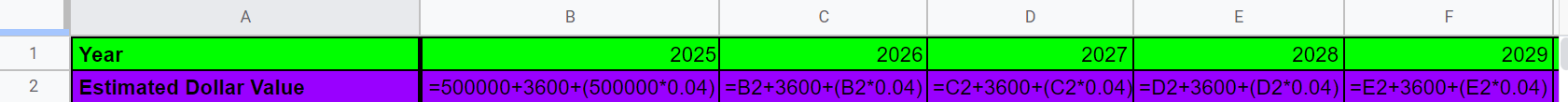

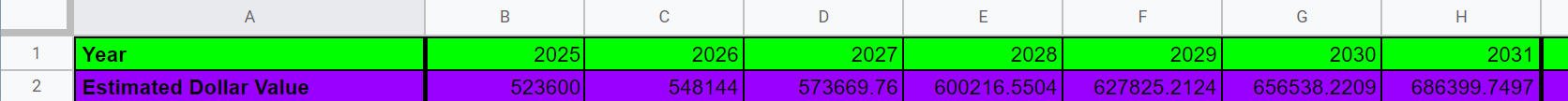

Row 2, will be filled with the estimated dollar value of your 401k by year. When entering in the formulas in row 2, you will start with an “=” sign, and stop at the .04), I put parentheses around the values you will enter into a cell. The calculated value, like $523,600 should automatically appear after putting the formula in. This formula assumes you are contributing $3,600 to your 401k every year, which breaks down to a monthly deposit value of $300. You can change that $3,600 value to be whatever amount you plan to contribute to your personal account.

Cell B2 “= $500,000+$3,600+($500,000*.04)” = $523,600

Cell C2 “= B2+$3,600+(B2*.04)” = $548,144

Cell D2 “= C2+$3,600+(C2*.04)” = $573,669

Cell E2 “= D2+$3,600+(D2*.04)” = $600,216

Cell F2 “= E2+$3,600+(E2*.04)” = $627,825

Cell G2 “= F2+$3,600+(F2*.04)” = $656,538

Cell H2 “= G2+$3,600+(G2*.04)” = $686,399

Cell I2 “= H2+$3,600+(H2*.04)” = $717,455

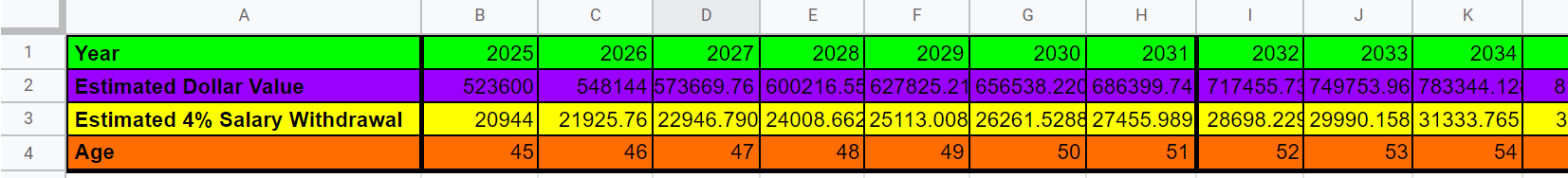

Once the information for row 2 are entered in, it will look something like the images below. For your reference the first image shows what the row will look like with formulas entered in the cells, and the second image shows what the row will look like with the calculated dollar values.

Row 3 will be populated by the estimated 4% salary withdrawal from your 401k each year. When entering in the formulas in row 3, you will start with an “=” sign, and stop at the .04. You can see parentheses around the values that need to be put into cells. The calculated value, like $20,944 should automatically appear after putting the formula in.

B3: “=B2*.04” = $20,944

C3: “=C2*.04” = $21,925

D3: “=D2* .04” = $22,946

E3: “=E2*.04” = $24,008

F3: “=F2*.04” = $25,113

G3: “=G2*.04” = $26,261

H3: “=H2*.04” = $27,455

I3: “=I2*.04” = $28,698

Once the information for row 3 are entered in, it will look something like the images below. For your reference the first image shows what the row will look like with formulas entered in the cells, and the second image shows what the row will look like with the calculated dollar values.

As shown in the images above, you can fill row 4 in with your age for easier tracking if you want.

Based on the calculations in our example above, a 4% withdrawal from your 401k of $27,455 can be achieved in 7 years at a retirement age of 51. However, you will not be able to collect social security until you are 62 years old. Based on the values used in this example, if you continue to work past 51 years of age contributing the same monthly amount of $300 or $3,600 a year, then you will reach a 4% withdraw equivalent to $45,000 at 63 years old.

Of course by 63 years old you will be able to collect social security, giving you a total annual salary of $45,000 + $18,000 = $63,000. This is just one example and there are multiple factors that can be changed to personalize this for your needs.

For details on how to create a budget to start planning your financial future visit the Girl Ninja’s How to Budget in 6 Easy Steps.